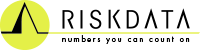

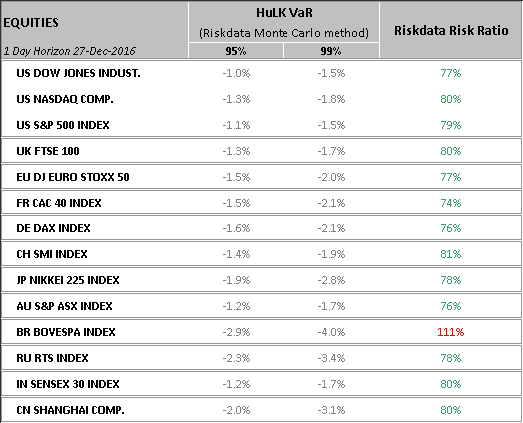

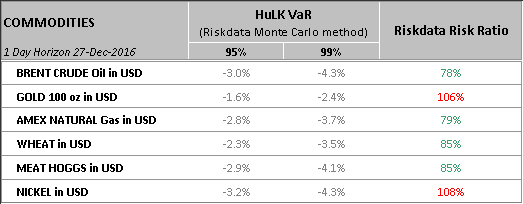

Latest Risks from Market

The HuLK VaR: Riskdata’s unique Monte Carlo methodology

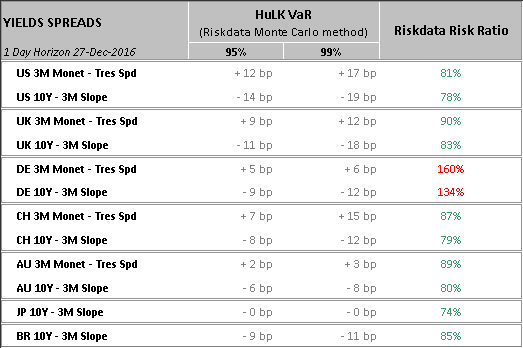

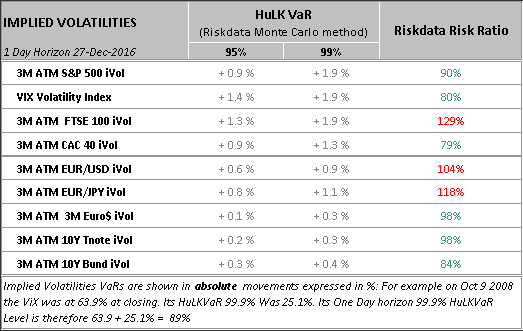

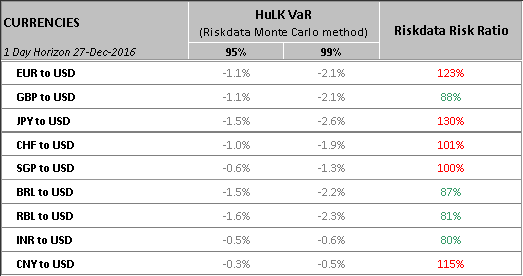

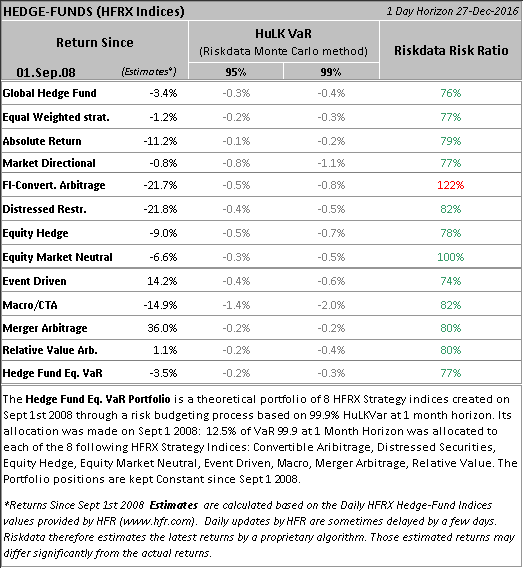

Riskdata has developed its own VaR calculation based on the Monte Carlo methodology to avoid over or under estimating risk across market crisis: the HuLK VaR.

The HuLK VaR is a much more responsive estimate that reacts rapidly to changing market regimes and anticipates increases and decreases in the Traditional VaR by using micro-signals that can be revealed sometimes in pre or post shock periods.

Have a taste of our HuLK VaR below since we daily publish our results for the main financial indexes across different asset classes.

Current VaR Across Market and

Asset Classes

VaR of HFRX hedge-fund indices is calculated using daily HFRX NaV’s provided by HFR.

Riskdata Risk Ratio = HuLK VaR / Traditionnal Monte Carlo VaR

Copyright © 2015 Riskdata SA. Above VaR information is provided for informational purposes only, and is not intended for trading purposes or advice.